Dispute Your FEMA Flood Zone

Think your property has been misclassified as high-risk? We can help fix that.

At Second Look Flood, we specialize in helping homeowners, real estate professionals, and insurance agents dispute inaccurate FEMA flood zone designations.

We manually review FEMA’s Flood Insurance Rate Maps (FIRMs) and provide the documentation you need to challenge forced flood insurance requirements—potentially saving you thousands of dollars.

Why You Might Be in the Wrong Flood Zone

It’s more common than you think.

Lenders and insurance companies sometimes rely on automated systems or outdated information when assigning flood zones. If your home is wrongly placed in a Special Flood Hazard Area (SFHA), you may be unnecessarily required to carry flood insurance—until you dispute it.

That’s where our team comes in.

Why You Need a Certified Report from Us

✅ FEMA-Sourced Accuracy

Our reports are built on the most current data from the Federal Emergency Management Agency (FEMA). This ensures you’re working with the same data your lender or insurer is using—only properly interpreted.

✅ Expert-Level Analysis

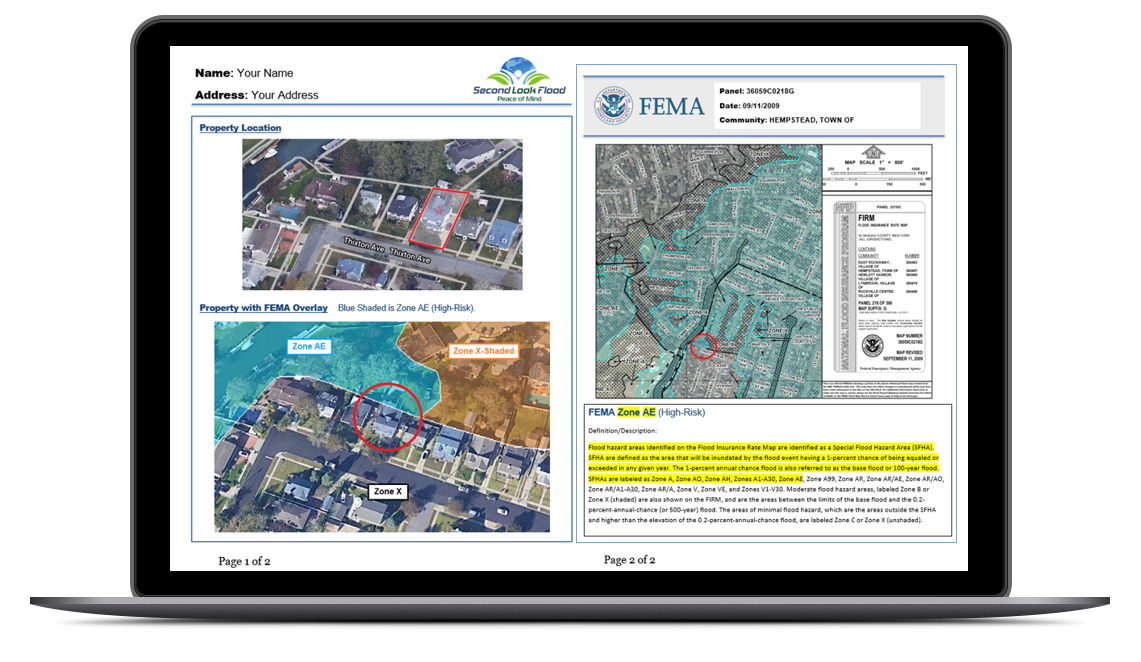

We don’t just send you a copy of the FEMA map. Our experienced Flood Map Specialists analyze your property’s exact location, base flood elevation, and FEMA map overlays to give you a precise, defensible flood zone determination.

✅ Clear and Easy-to-Use Format

Flood zone designations can be confusing. That’s why we design our reports to be clear, visual, and lender-ready—featuring color-coded maps, highlighted zones, and simple explanations you (and your lender) can easily understand.

“Just an update- The lending institution, processing our refinance, has lifted all requirements for flood insurance on our property. Again, thank you for your help and support. Your feedback, suggestions and pictures of our property brought the clarity and facts we needed to change their decision. Thanks!”

Ready to Dispute Your Flood Zone?

If you’ve been force-placed into flood insurance—or want to challenge a lender’s flood zone determination—our certified report is the first step.

Let us help you take back control.