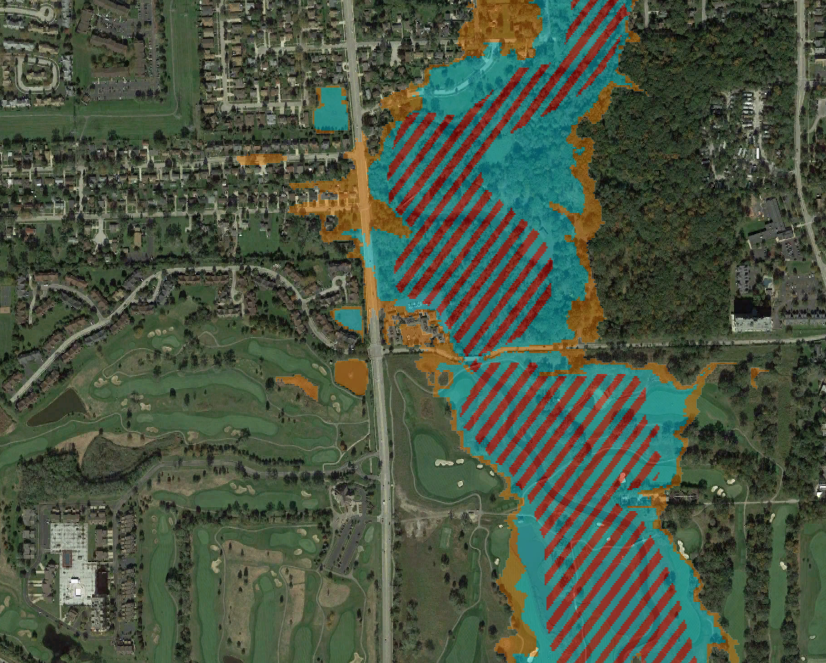

“We are looking at purchasing property that lies in a valley area. Because of the location, am I at risk for flooding?”

“I hope you realize that you and your company are one in a million. Again many th“I hope you realize that you and your company are one in a million. Again many thanks and so that you know; in my neck of the woods word of mouth is the best advertising. I promise to give your company name and e-mail to anyone who needs your services.” -Roger in Maine

Know Before You Purchase

Picture this- You’ve just found your dream home, it’s in a beautiful neighborhood, perfect size, and within your budget. Everything seems perfect until you discover that the property is located in a flood zone. Suddenly, a sense of uncertainty fills your mind. Will the property flood? How will it affect the house’s durability and value? What about insurance costs?

Now, imagine having all this information upfront, allowing you to make an informed decision. That’s exactly why flood zone disclosure is crucial when buying real estate. It ensures that you’re aware of any potential flood risks associated with the property, giving you peace of mind and saving you from potential financial burdens.

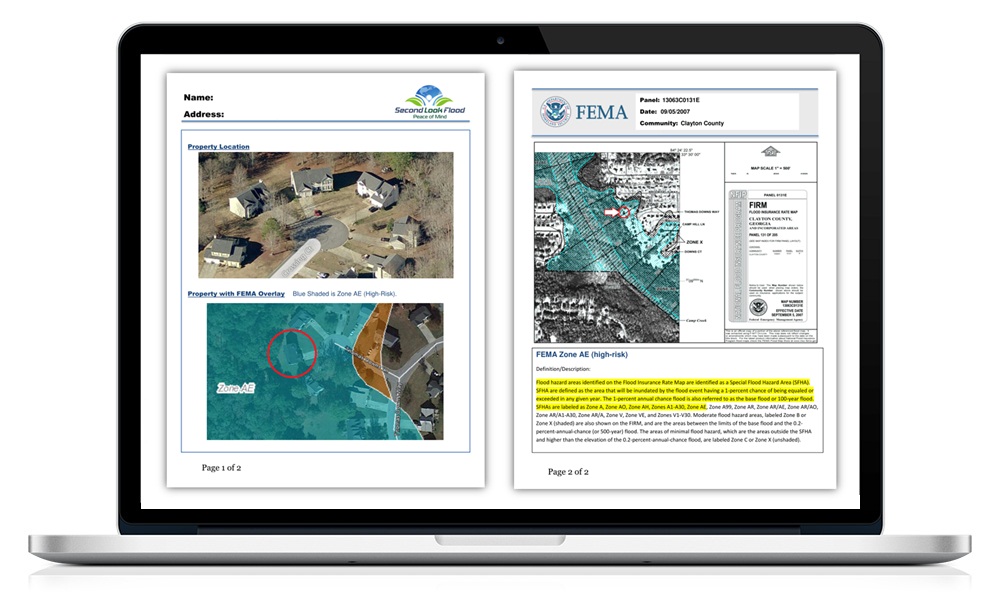

At Second Look Flood, we understand the significance of flood zone disclosure. We believe in transparency and ensuring that our clients have all the necessary information before they make one of the most significant financial investments in their lives. Our team works diligently to gather all relevant flood zone information from federal and local sources and flood insurance requirements.

With our comprehensive flood zone disclosure, you can expect:

1) Peace of Mind: Our disclosed flood zone information provides you with peace of mind as you know exactly what you are getting into. You can make an informed decision, knowing the potential risks and implications of any flood-related incidents.

2) Risk Assessment: Our flood zone disclosure allows you to assess the potential risk of flooding associated with the property. You can better understand if the property’s location aligns with your risk tolerance and if additional measures, such as flood insurance, are necessary.

3) Financial Protection: By knowing the flood zone status, you’ll have a clearer understanding of potential insurance costs and any requirements for flood insurance. This knowledge can help you budget and plan accordingly, ensuring you are financially protected in case of a flood event.