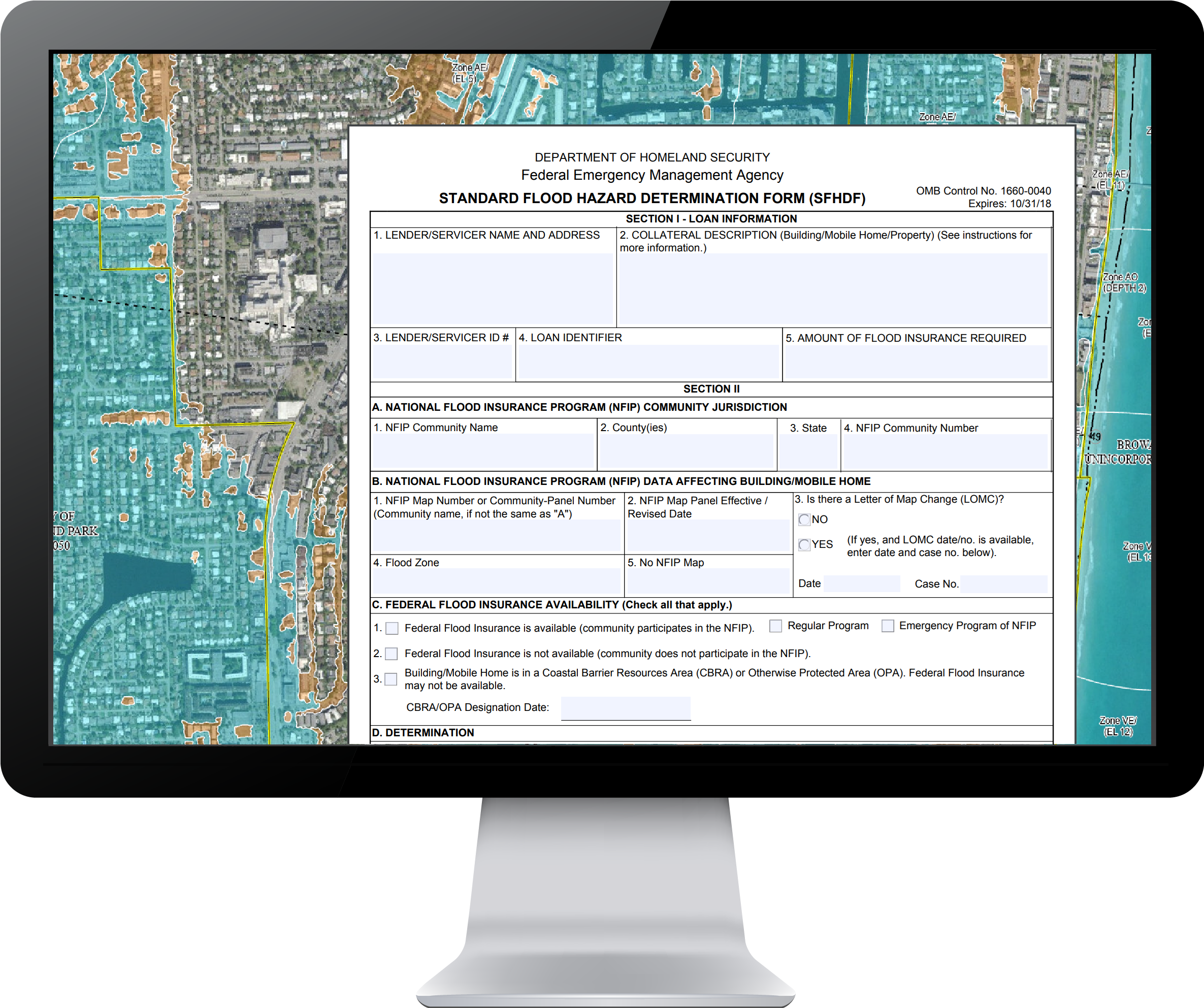

FEMA Standard Flood Hazard Determination Form

Get an official FEMA flood hazard determination — fast, accurate, and affordably priced.

At Second Look Flood, we offer the FEMA Standard Flood Hazard Determination Form (SFHDF) directly to the public — a rare service typically only available through lenders or government portals.

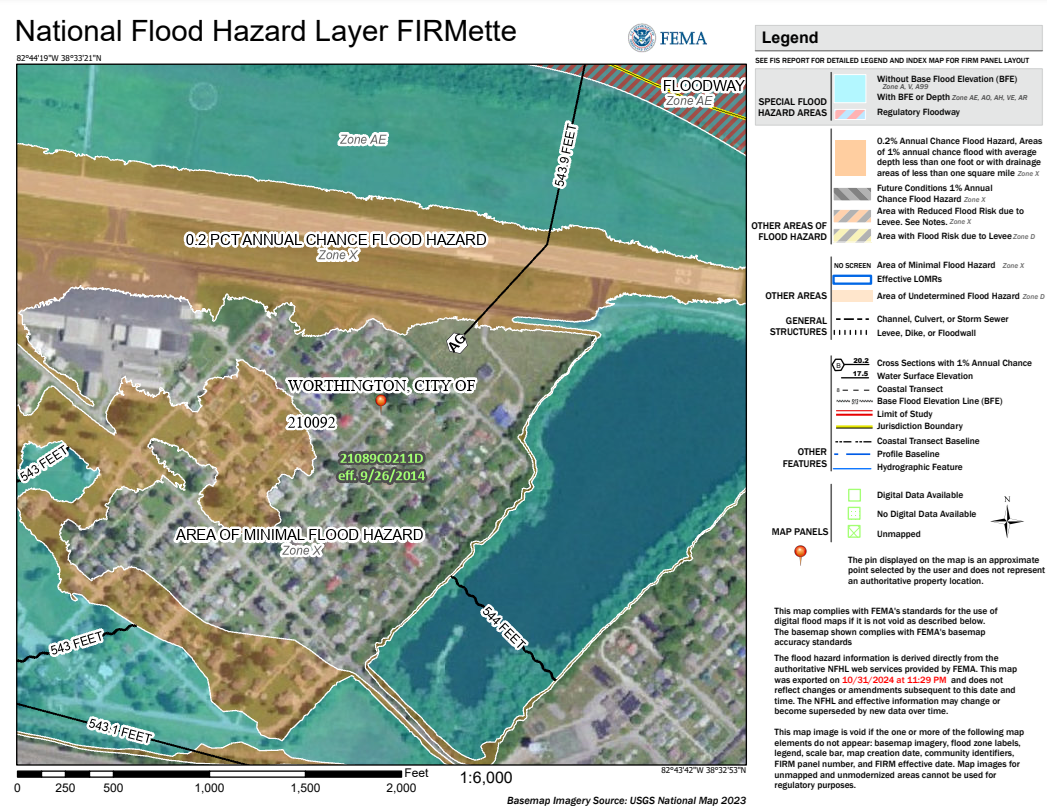

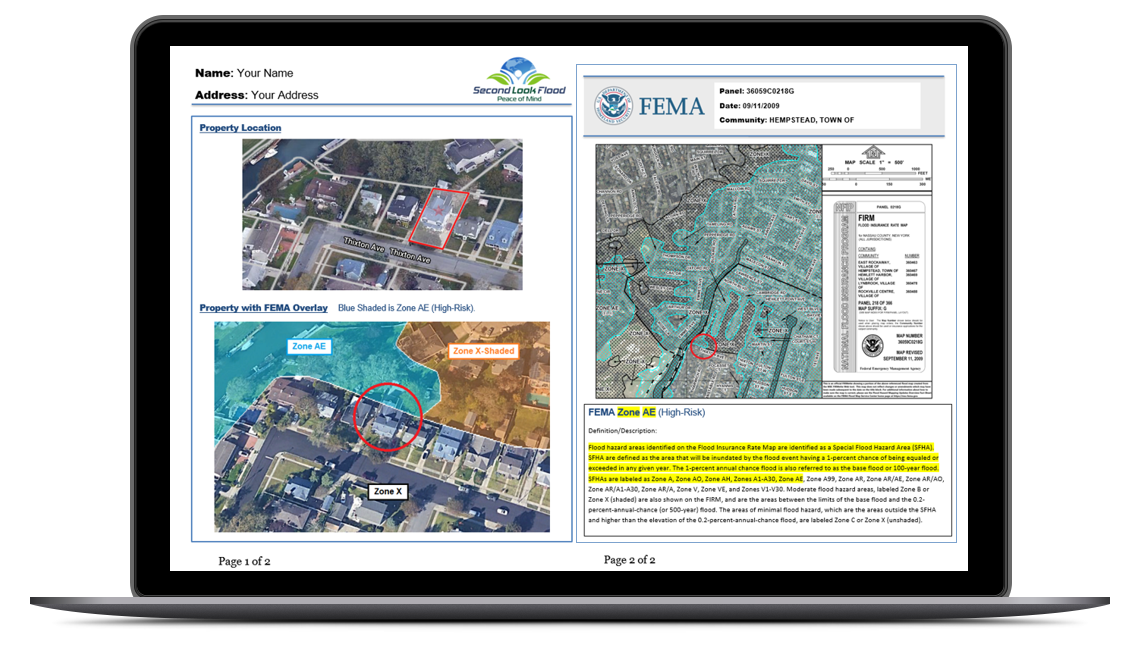

Our SFHDF service gives you clear, official documentation of whether your property is located in a Special Flood Hazard Area (SFHA), based on FEMA’s latest maps and data.

What Is the SFHDF?

The Standard Flood Hazard Determination Form is a federally standardized form used to determine whether a structure is located within a FEMA-designated high-risk flood zone. It’s required in most federally backed mortgage transactions — but it’s also incredibly useful for:

-

Homeowners who want official FEMA flood zone verification

-

Insurance agents preparing documentation for a new or existing policy

-

Real estate professionals during transactions

-

Property owners disputing a lender’s flood insurance requirement

-

Anyone needing a formal, documented FEMA flood zone status

Why Order from Second Look Flood?

✅ Public Access — No Lender Required

Unlike most providers, we offer this service directly to individuals—not just financial institutions.

✅ Lower Cost Than FEMA

FEMA offers the SFHDF through their platform at $80 per request.

Our version is significantly more affordable, with the same accuracy and data compliance.

✅ Fast Turnaround & Easy Ordering

Submit your address online, and our team delivers a completed SFHDF quickly — typically within 24 hours.

✅ Backed by Certified Flood Map Specialists

We don’t just fill out a form — our experts manually verify FEMA zone data and provide the most accurate result possible.

What You’ll Receive

-

Completed FEMA SFHDF form, filled and signed by a Flood Zone Specialist

-

Your property’s FEMA flood zone status

-

The applicable FEMA map panel and community number

-

Verification of whether the structure is in an SFHA (Zone A or V)

-

Documentation you can use with lenders, insurers, or local government